This blog post has been researched, edited, and approved by John Hanning and Brian Wages. Join our newsletter below.

Tax Credits, Incentives, and Deductions Guide

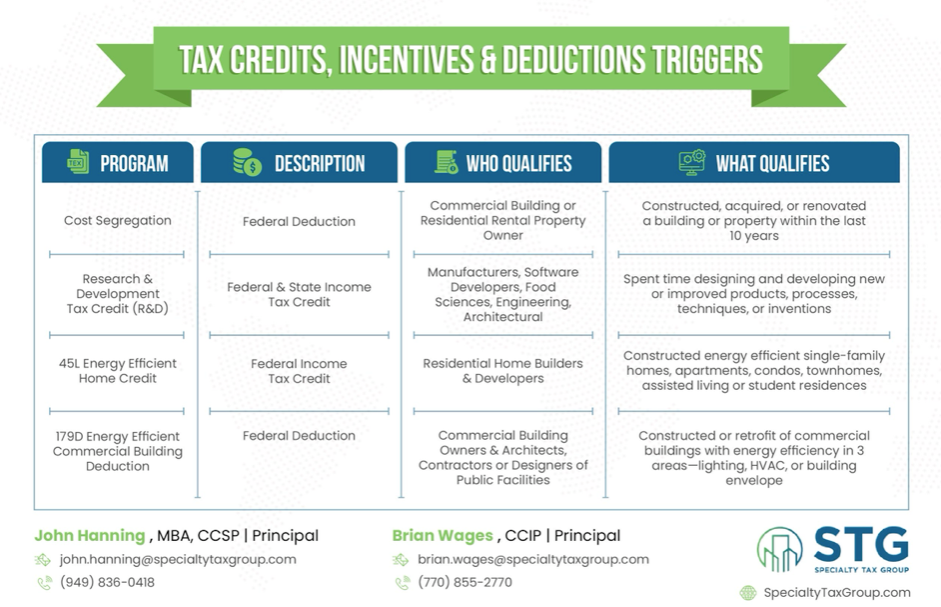

In the realm of business, leveraging financial incentives like tax credits and deductions can significantly impact your company's growth trajectory and sustainability efforts. Today, we delve into several critical tax incentives that could benefit various businesses, including Cost Segregation, Research & Development (R&D) Tax Credits, the 45L Energy Efficient Home Credit, and the 179D Energy Efficient Commercial Building Deduction. Understanding these can help businesses optimize their investments and operations for better financial health and contribution to sustainability.

Cost Segregation

Cost Segregation is a strategic tax savings tool that allows commercial building or residential rental property owners to accelerate depreciation deductions, thereby reducing taxes and boosting cash flow. This involves identifying property assets that can be reclassified into shorter depreciation time frames. Qualification hinges on whether you've constructed, acquired, or renovated a building within the last decade, emphasizing the potential for immediate financial benefits.

Research & Development Tax Credit

The R&D Tax Credit offers a dollar-for-dollar tax saving for businesses engaged in developing new or improved products, processes, techniques, or software. It applies to a wide array of industries, including manufacturing, software development, food sciences, engineering, and architectural fields. If your company invests time and resources in innovation, this credit can significantly reduce both federal and state income tax liabilities, encouraging continued investment in R&D activities.

45L Energy Efficient Home Credit

This credit benefits residential home builders and developers who construct energy-efficient housing, including single-family homes, apartments, condos, townhomes, assisted living, or student residences. By meeting specific energy-saving criteria, developers can receive a federal income tax credit, underlining the government's support for sustainable housing development and the broader initiative towards energy conservation.

179D Energy Efficient Commercial Building Deduction

Similar to the 45L credit but for commercial buildings, the 179D deduction supports the construction or retrofit of energy-efficient systems in three key areas: lighting, HVAC (heating, ventilation, and air conditioning), and the building envelope (the barrier between the interior and exterior). Commercial building owners, as well as architects, contractors, or designers working on tax-exempt facilities, can benefit from this federal deduction, promoting the adoption of green building practices.

Who Benefits?

These incentives cast a wide net, encompassing a diverse range of beneficiaries from property owners and builders to innovators across various industries. By capitalizing on these financial mechanisms, businesses can not only reduce their tax liabilities but also contribute to the broader goals of energy efficiency and innovation.

| Program | Type | Beneficiaries | Qualification |

|---|---|---|---|

| Cost Segregation | Federal Deduction | Commercial Building or Residential Rental Property Owners | Constructed, acquired, or renovated a building within the last 10 years |

| R&D Tax Credit | Federal & State Income Tax Credit | Manufacturers, Software Developers, Food Sciences, Engineering, Architectural | Designing/developing new or improved products, processes, techniques, or inventions |

| 45L Energy Efficient Home Credit | Federal Income Tax Credit | Residential Home Builders & Developers | Constructed energy-efficient residential buildings |

| 179D Energy Efficient Commercial Building Deduction | Federal Deduction | Commercial Building Owners & Architects, Contractors or Designers of Public Facilities | Constructed or retrofitted commercial buildings with specific energy-efficient systems |

Frequently Asked Questions

Can small businesses qualify for the R&D Tax Credit?

Yes, small businesses, including startups, can qualify for the R&D Tax Credit if they engage in qualifying research activities. The scope of what constitutes R&D is broader than many realize, covering not only groundbreaking innovations but also incremental improvements.

What specific energy-saving requirements must be met for the 45L Energy Efficient Home Credit?

Homes must meet certain energy efficiency standards that typically exceed national energy codes. This often involves better insulation, energy-efficient windows, tight construction and ducts, and efficient heating and cooling equipment.

How does the 179D deduction vary for different stakeholders like architects or public facility contractors?

Architects, contractors, or designers of public facilities can qualify for the 179D deduction even if they don't own the property. This is unique because it extends tax benefits to those responsible for the design of energy-efficient public buildings, recognizing their role in promoting sustainability.