This blog post has been researched, edited, and approved by John Hanning and Brian Wages. Join our newsletter below.

Newsletter Form

Thank you for joining our newsletter. We will email you the latest updates every other Thursday at 12pm.

Please try again later.

A Tax Credit & Incentives Guide

Georgia's economic landscape is bustling with opportunities for businesses, thanks to a range of tax credits designed to foster growth, innovation, and job creation within the state. These incentives not only benefit businesses but also contribute to the broader economic development of Georgia.

In this educational blog post, we'll delve into the details of some key programs such as the Georgia Retraining Tax Credit, Georgia Jobs Tax Credit, and the Georgia Investment Tax Credit, among others, as outlined in STG's CPA Handbook. Understanding these can be pivotal for businesses looking to expand, innovate, or simply optimize their operations in Georgia.

Georgia Retraining Tax Credit

The Georgia Retraining Tax Credit program is a testament to the state's commitment to continuous learning and adaptation. It offers up to $1,250 per qualified employee per year, targeting industries with a Georgia Income Tax Liability. Any company employing at least 10 or more individuals should at least look into this tax credit program. The aim is to encourage businesses to invest in their workforce through training on new or upgraded software, equipment, or technology, ensuring that employees remain competitive in a rapidly evolving technological landscape.

Georgia Jobs Tax Credit

Creating job opportunities is at the heart of economic growth, and Georgia incentivizes this through the Georgia Jobs Tax Credit. Businesses can receive a credit of $1,250 to $4,000 for every new job created, for five years as long as the jobs are maintained. This incentive is available to companies within a “business enterprise” or preferred industry such as manufacturing or warehousing and distribution or any new or expanding company adding headcount if creating at least two new jobs in a specially designated zone. This initiative underscores Georgia's focus on not just job quantity but also quality and sustainability.

Georgia Investment Tax Credit

For manufacturers or telecommunications companies making significant investments in equipment, the Georgia Investment Tax Credit offers a credit of 1% to 8% of equipment expenditure. The facilities must have been operating in Georgia for at least three years and planning to invest a minimum of $100,000 in relevant equipment. The credit highlights Georgia's support for sectors that are pivotal to the state's industrial and technological advancement.

Who Qualifies and How

The eligibility criteria for these incentives are broad, encompassing a range of industries and activities. From companies with a Georgia Income Tax Liability employing 10 or more individuals to those investing in manufacturing or telecommunications equipment, the state provides a fertile ground for diverse business operations. Whether you're a startup eyeing expansion or an established entity looking to innovate, these tax credits and incentives offer a compelling reason to choose Georgia as your business base.

Navigating the Process

Navigating the complexities of tax incentives can be challenging, but with resources like STG's CPA Handbook and the expertise of professionals like John Hanning, MBA, CCSP, and Brian Wages, CCIP, businesses can effectively leverage these opportunities. These incentives are designed not just as a financial boon but also as a catalyst for long-term growth and sustainability.

Conclusion

Georgia's tax credits are pivotal tools in the state's economic development arsenal. They signal Georgia's proactive stance in supporting businesses across various phases of growth, from training and job creation to significant capital investments. For businesses, understanding and utilizing these incentives can lead to substantial savings, enhanced competitiveness, and a solid foundation for future growth.

As Georgia continues to cultivate a business-friendly environment, these programs underscore the state's commitment to fostering innovation, job creation, and sustainable development.

For businesses looking to explore these opportunities further, consulting with tax professionals and leveraging resources like STG's CPA Handbook can provide invaluable guidance. With the right approach, businesses can not only benefit financially but also contribute to the thriving economic landscape of Georgia.

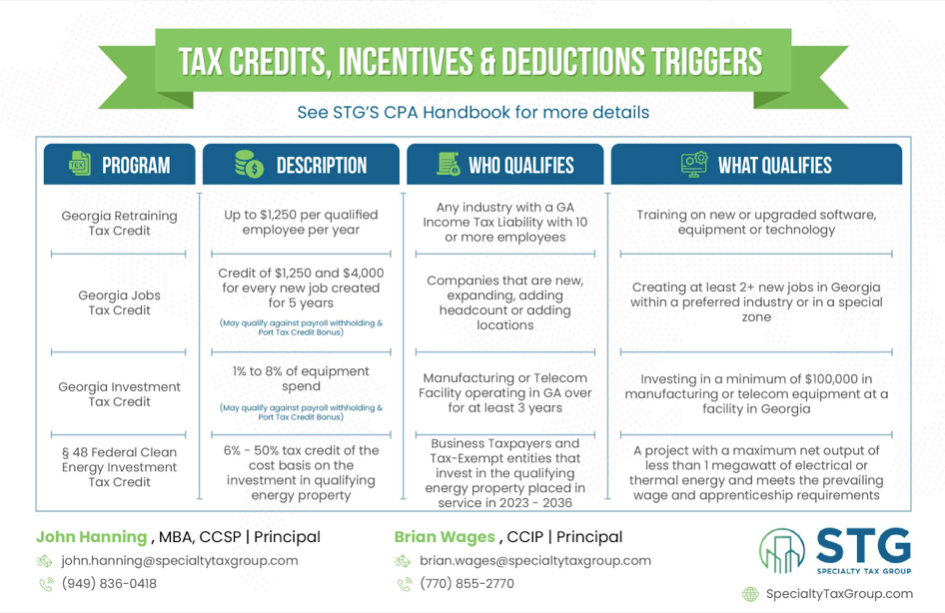

| Program Name | Description | Who Qualifies | What Qualifies |

|---|---|---|---|

| Georgia Retraining Tax Credit | Up to $1,250 per qualified employee per year | Any industry with a GA Income Tax Liability with 10 or more employees | Training on new or upgraded software, equipment, or technology |

| Georgia Jobs Tax Credit | Credit of $1,250 and $4,000 for every new job created for 5 years | Companies that are new, expanding, adding headcount, or adding locations | Creating at least 2+ new jobs in Georgia within a preferred industry or in a special zone |

| Georgia Investment Tax Credit | 1% to 8% of equipment spend | Manufacturing or Telecom Facility operating in GA for at least 3 years | Investing in a minimum of $100,000 in manufacturing or telecom equipment at a facility in Georgia |

| § 48 Federal Clean Energy Investment Tax Credit | 6% 50% tax credit of the cost basis on the investment in qualifying energy property | Business Taxpayers and Tax-Exempt entities that invest in qualifying energy property placed in service in 2023 - 2036 | A project with a maximum net output of less than 1 megawatt of electrical or thermal energy and meets the prevailing wage and apprenticeship requirements |

Frequently Asked Questions

-

How do I know if my business qualifies for the Georgia Retraining Tax Credit?

To qualify for the Georgia Retraining Tax Credit, your business must have a Georgia Income Tax Liability. The credit is aimed at businesses investing in the training of their employees on new or upgraded software, equipment, or technology. If your business is undertaking such training initiatives, you likely qualify. Any industry qualifies for this credit, however, it's recommended to consult with a tax professional or utilize resources like STG's CPA Handbook for a detailed understanding of eligibility criteria.

-

Can startups apply for the Georgia Jobs Tax Credit?

Yes, startups can apply for the Georgia Jobs Tax Credit, provided they meet the program's eligibility criteria. This includes creating at least two new jobs if the company is located within a special zone. If within a business enterprise (or preferred industry) the job creation threshold ranges from 2 to 25. The program is designed to support companies that are new, expanding, adding headcount, or adding locations in Georgia. If your startup is contributing to job creation in the state, this tax credit can offer substantial benefits over a five-year period.

2024 Tax Guide

Ready For A Conversation?

Contact us today and our friendly team will reach out as soon as possible.

Our Recent Posts

Read Our Blogs

All Rights Reserved | Specialty Tax Group | Powered by Automationlinks | Privacy Policy