Specialty Tax Group

Cost Segregation

What is Cost Segregation?

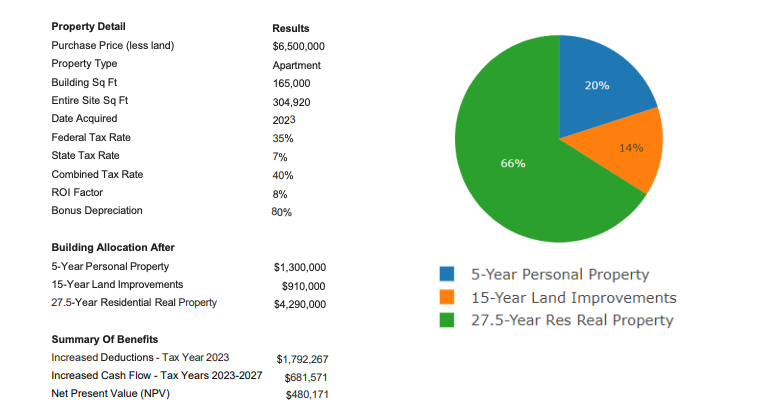

Cost Segregation is a valuable strategy to increase cash flow and reduce income taxes for commercial property owners. The tax benefits of cost segregation can be applied to various types of real estate: apartments, assisted living/nursing homes, auto dealerships, office buildings, restaurants, manufacturing, hotels, medical buildings, retail space and others. The process of Cost Segregation segregating 1245 personal property components 1250 land improvements from the real property of a building, resulting in depreciable lives of 5, 7 and 15 years using accelerated depreciation

Specialty Tax Group’s expert analysis will identify costs that may qualify for accelerated depreciation. For example, we will go as far as to break out the cost of electrical or plumbing required to operate machinery from general building costs. A cost segregation specialist can assist in realizing significant depreciation deductions with:

Types of Transactions

- Constructed Facilities, Renovations, Remodels, or Expansions

- Acquisitions (Current Year or Lookbacks)

- Tenant Leasehold Improvements

For more information about our Cost Segregation services.

Ready For A Conversation?

Contact us today and our friendly team will reach out as soon as possible.

Our Recent Posts

Read Our Blogs

All Rights Reserved | Specialty Tax Group | Powered by Automationlinks | Privacy Policy